property tax in france 2020

What are the rules for a mortgage in France. So the difference between the price you bought it for and the price.

French Property Income Tax Non Resident Tax Return Filing Pti

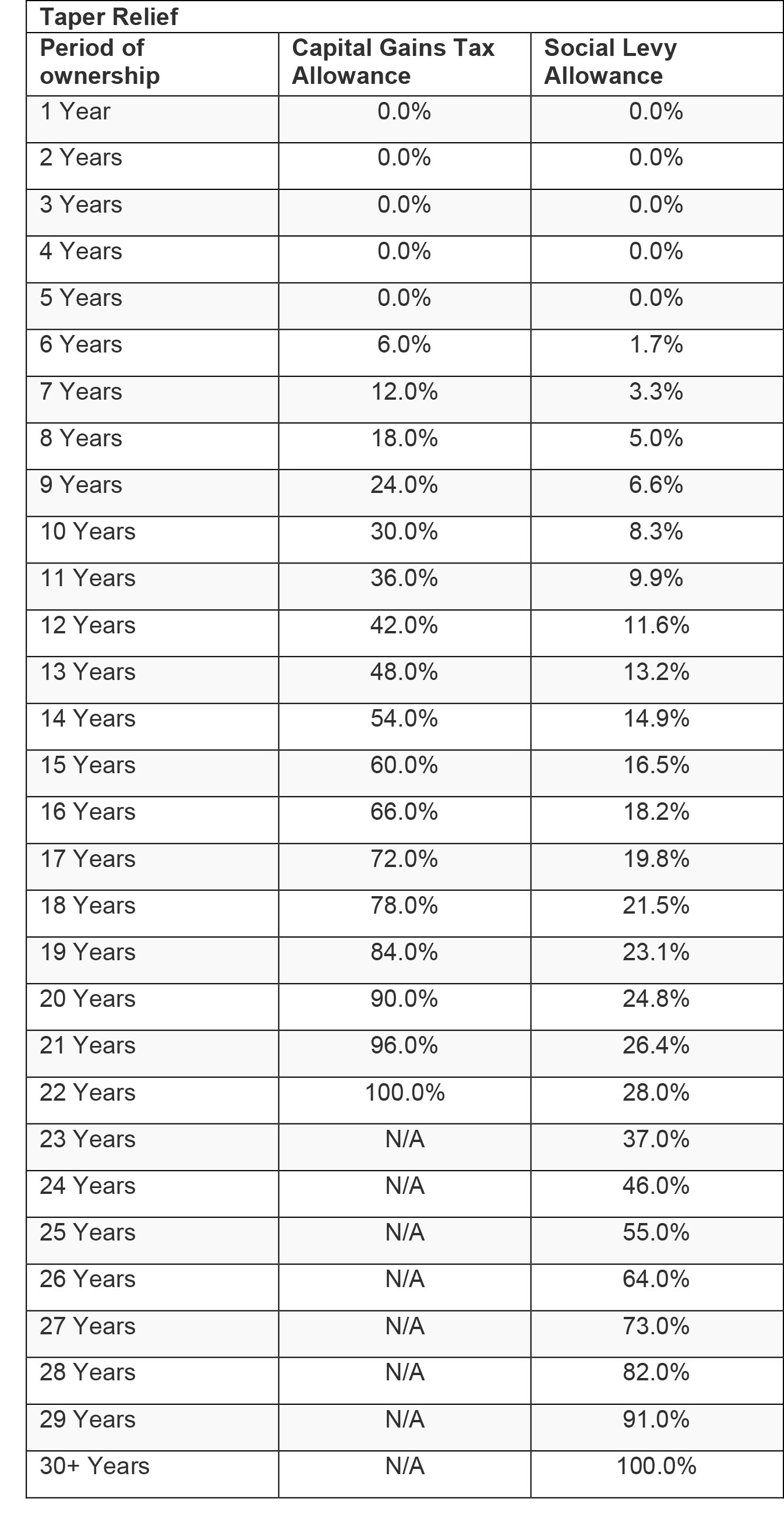

Capital gains tax in France impôt sur les plus values is payable on the sale of buildings land and shares.

.png)

. Capital gains on the sale of professional. Residence tax or occupiers tax - Taxe dHabitation. Unmarried couples should complete separate tax returns.

Broadly speaking your debt ratio in a mortgage. June 12th closing date for tax declarations done on paper. Thats why we have created this tool in order to help you estimate your personal income tax burdern in France based on the latest fiscal data from the French authorities for 2019.

Meanwhile for second homes the tax rate varies between 12 17 depending on the rateable value of the property. A single flat-rate tax of 30 is applied on savings and investment. And The rate from 1 January 2021 is 275 for all income.

If you have children you may be entitled to housing tax. France Non-Residents Income Tax. The rates for the year 1 January to 31 December 2020 are 28 on the first EUR 500000 and 31 on the excess.

The first one is the taxe fonciere or land tax the second one is the taxe dhabitation council tax which is provided for guidance only as it is. Property Tax In France 2020. The current threshold of 1300000 for the IFI real estate wealth tax will stay in place for 2020 with no changes to the scale rates of tax.

This year that exemption increases to 100 for households whose net taxable income revenu fiscal de référence in 2019 was no greater than 27706 for a single person. Any assets located outside of France will be exempt from the ISF for 5 years. The highest property taxes as a share of the private capital stock occur in the United Kingdom 193 percent France 125 percent and Greece 109 percent.

If you become resident in France you will only be taxed on your French assets for the first 5 years of residency. This relates to taxes owed for 2019 and anyone resident in France from April 2019 and onwards needs to fill in a return. Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary.

Capital gains on real property realised by listed real estate investment companies French SIIC are subject to a tax rate of 19. Generally a mortgage in France will be for 20-25 years sometimes extended up to 30-35 years. There are two local property taxes in France payable by both residents and non-residents.

This tax known as impôt sur les plus values in France is payable on the profits of selling a property or land. This French housing tax deemed unfair. So this year 2020 you will be declaring according to your situation between 1 January 31 December 2019.

Average Price Of U S Real Estate Sold By Country International Tax Blog

Understanding French Property Tax

French Property Tax The Local Buzz Which Taxes Are You Due To Pay

French Taxes I Buy A Property In France What Taxes Should I Pay

How To Live The Good Life In France Property Purchase Finance And Taxes The Good Life France

Jasa Konsultan Pajak Tax Consultant Enforce A

In Depth Guide To French Property Taxes For Non Residents Expats

French Property Tax For Non Residents Ptireturns Com Blog

Changes For Residential Property Taxes From 6 April 2020 French Duncan Professional Chartered Accountants

Revenue Of Property Tax France 2018 Statista

Selling A French Property What Happens After Brexit Lawskills

Quick Overview Of French Real Estate Tax Rsm France

French Property Income Tax Non Resident Tax Return Filing Pti

List Of Countries By Tax Rates Wikipedia

Tax Revenue Statistics Statistics Explained